aurora sales tax rate

The County sales tax rate is. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

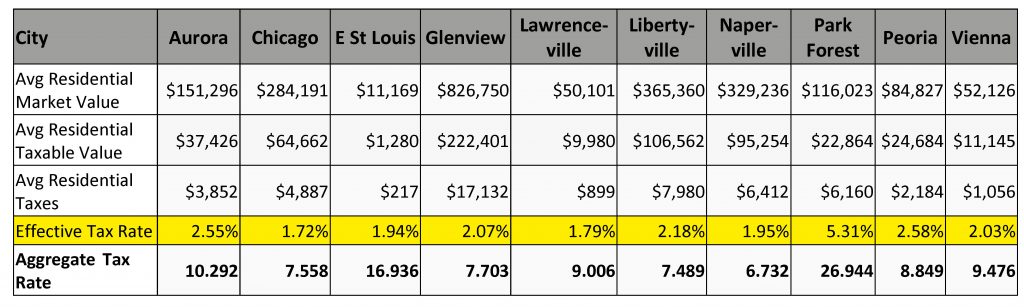

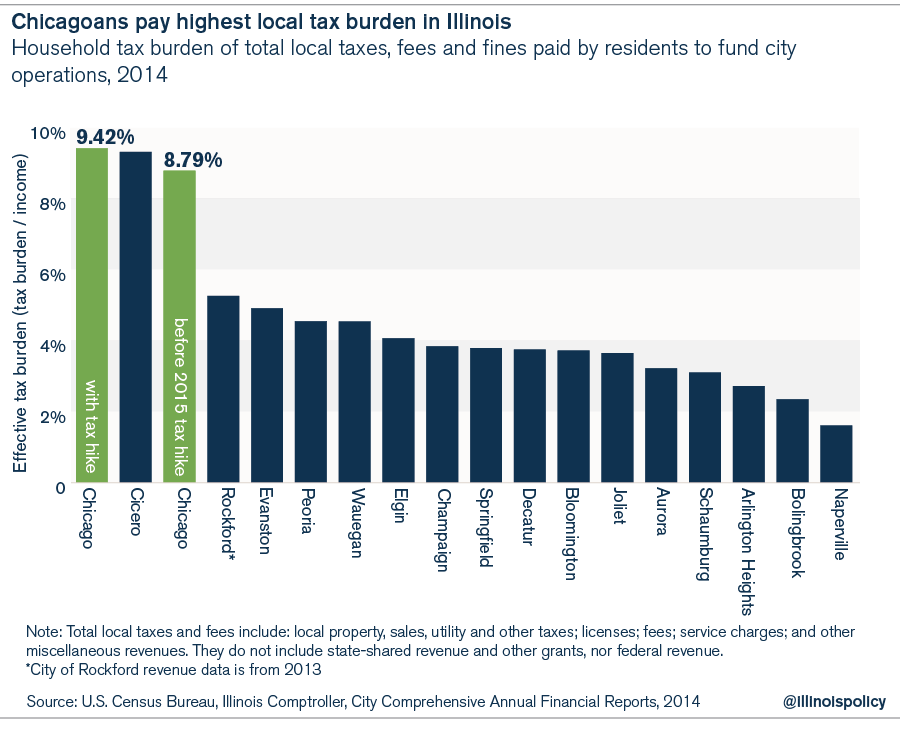

Taxpayers Federation Of Illinois Aurora Tops In Effective Tax Rate Low In Local Government Spending Mike Klemens

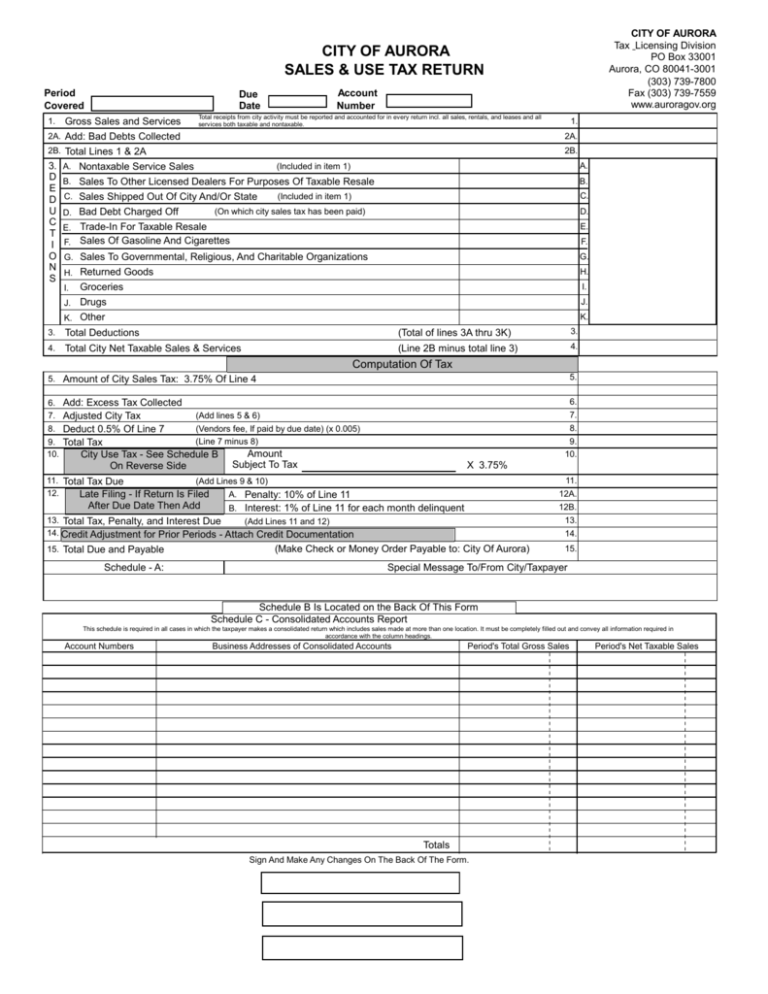

Contact Us Tax Division.

. Aurora OH Sales Tax Rate. The Aurora sales tax rate is. The 55 sales tax rate in Aurora consists of 45 South Dakota state sales tax and 1 Aurora tax.

All services are provided electronically using the tax portal. Tax and Licensing Calendar. The current total local sales tax rate in Aurora OH is 7000.

Integrate Vertex seamlessly to the systems you already use. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax. The December 2020 total.

MO Sales Tax Rate. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax.

The minimum combined 2022 sales tax rate for Aurora North Carolina is. You can print a 8 sales tax table here. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

The minimum combined 2022 sales tax rate for Aurora Colorado is. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The current total local sales tax rate in Aurora IL is 8250.

What is the sales tax rate in Aurora North Carolina. This is the total of state county and city sales tax rates. The Aurora sales tax rate is.

The County sales tax rate is. IL Sales Tax Rate. The current total local sales tax rate in Aurora OR is 0000.

The minimum combined 2022 sales tax rate for Aurora South Dakota is. There is no applicable city tax or special tax. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The current total local sales tax rate in Aurora CO is 8000. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. The sales tax jurisdiction name is Venice which may refer to a local government division.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Get the benefit of tax research and calculation experts with Avalara AvaTax software. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The South Dakota sales tax rate is currently. The North Carolina sales tax rate is currently. The County sales tax rate is.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. This is the total of state county and city sales tax rates. Special Event Tax Return.

The current total local sales tax rate in Aurora MO is. The December 2020 total local sales tax rate was also 8250. There is no applicable county tax or special tax.

5 rows The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams. This is the total of state county and city sales tax rates. There is no applicable special.

Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The December 2020 total. The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax.

The current total local sales tax rate in Aurora SD is 5500. SD Sales Tax Rate. You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables.

The Colorado sales tax rate is currently. There is no applicable county tax or special tax. The December 2020 total local sales tax rate was also 5500.

A one page summary of Aurora tax rates can be found below. You can print a 55 sales tax table here.

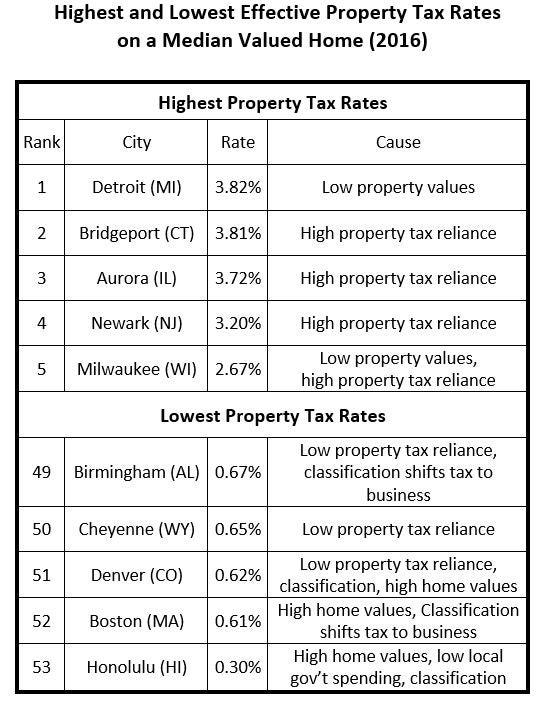

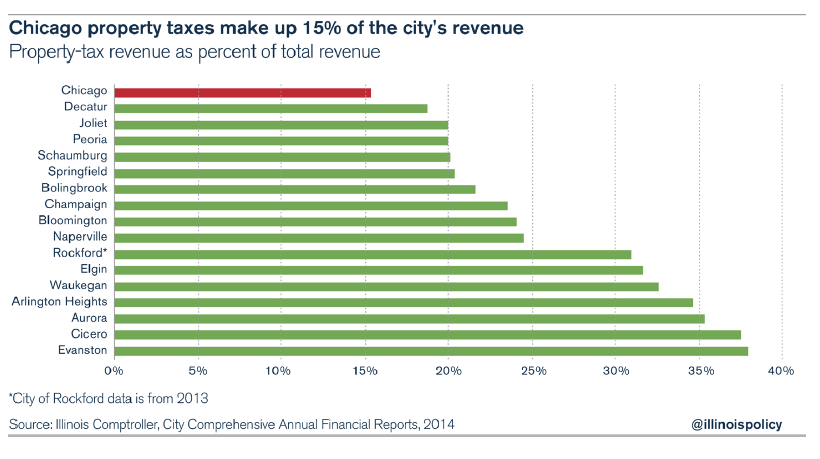

U S Property Taxes Comparing Residential And Commercial Rates Across States

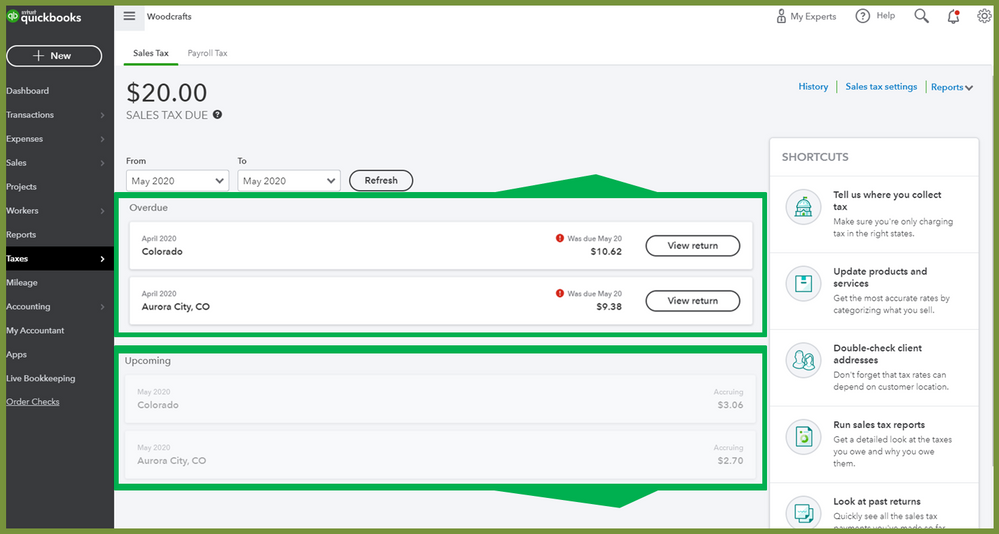

Set Up Automated Sales Tax Center

Kansas Sales Tax Rates By City County 2022

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Colorado Sales Tax Rates By City County 2022

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com

How Colorado Taxes Work Auto Dealers Dealr Tax

Nebraska Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com